Salto for

NetSuite

Articles

SHARE

The Cogs Behind the Cumulative Translation Adjustments (CTA) Account

Sonny Spencer, BFP, ACA

May 5, 2024

15

min read

Introduction

For companies that operate in multiple currencies, the Cumulative Translation Adjustment (CTA) account is a key component of the NetSuite consolidated balance sheet. Because exchange rate differences often arise when converting the financial statements of foreign subsidiaries into the reporting currency of the parent company, the CTA account is crucial for capturing this information and ensuring accuracy across financial reports. In this blog post, we’ll take a closer look at how the CTA is derived and calculated, exploring this process through a canned NetSuite report. We’ll also take a look at the impact of running the CTA balance audit report for different accounting periods.

How is CTA calculated?

CTA is essentially the sum of every GL account balance in every subsidiary in your NetSuite environment, multiplied by its respective consolidated exchange rate.

Imagine you have a Canadian dollar (CAD) trial balance in your NetSuite environment and you need to convert that trial balance into the consolidated currency of US dollars (USD). Your CAD trial balance will net to zero, as all trial balances should.

But now imagine taking each of those balances and multiplying them by different consolidated exchange rates to get to a USD trial balance. Would you expect that trial balance to net to zero? Well, you shouldn't. In fact, the only case where it should net to zero is when each of the consolidated exchange rates—the current rate, the average rate, and the historical rate—are using the exact same exchange rate. As such, the USD trial balance will not net to zero. The difference is actually the CTA, which is the delta on that USD trial balance.

An important note here is that the CTA account is separate from the CTA Elimination account. The CTA Elimination account balance is the delta between intercompany GL accounts that have been eliminated. In other words, the CTA Elimination balance is generated when we run the elimination process in NetSuite. CTA is different, and it's generated when we run our consolidation process.

CTA Balance Audit Report

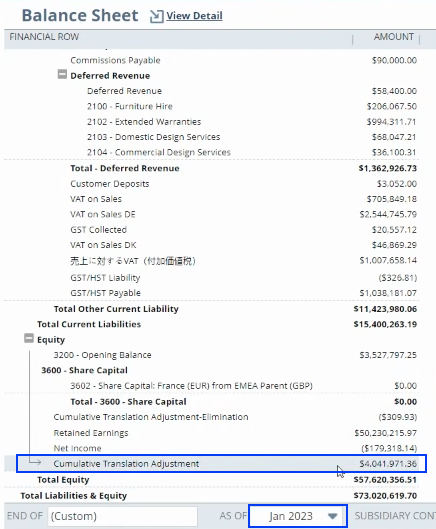

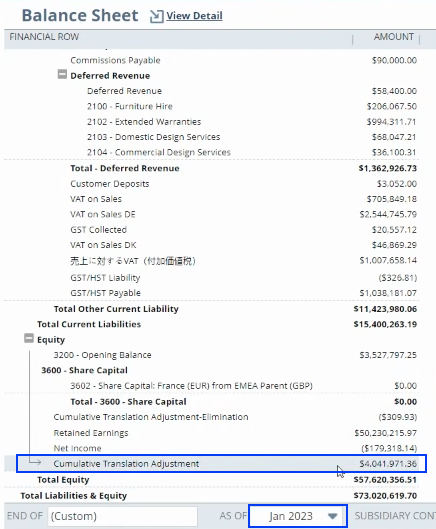

To review the CTA balance audit report, we’ll first navigate to our consolidated balance sheet in NetSuite, scroll down to the equity section, and reference the CTA balance at the bottom. We can see in the image below that the balance is just over USD $4,000,000 for the accounting period January 2023.

If we click on that balance, NetSuite will take us to the CTA balance audit report for that accounting period.

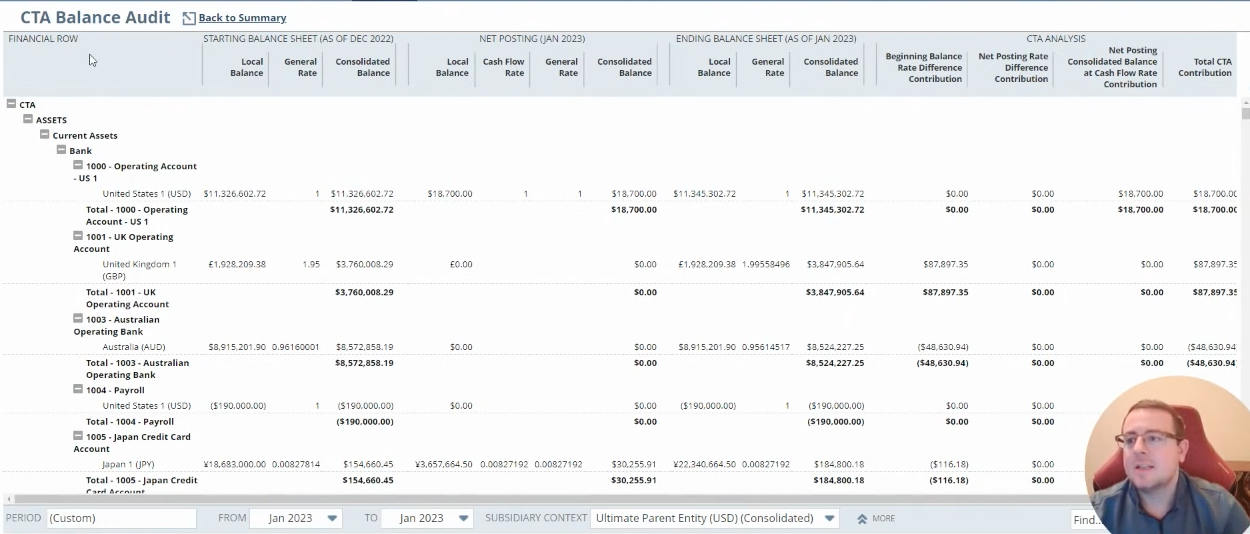

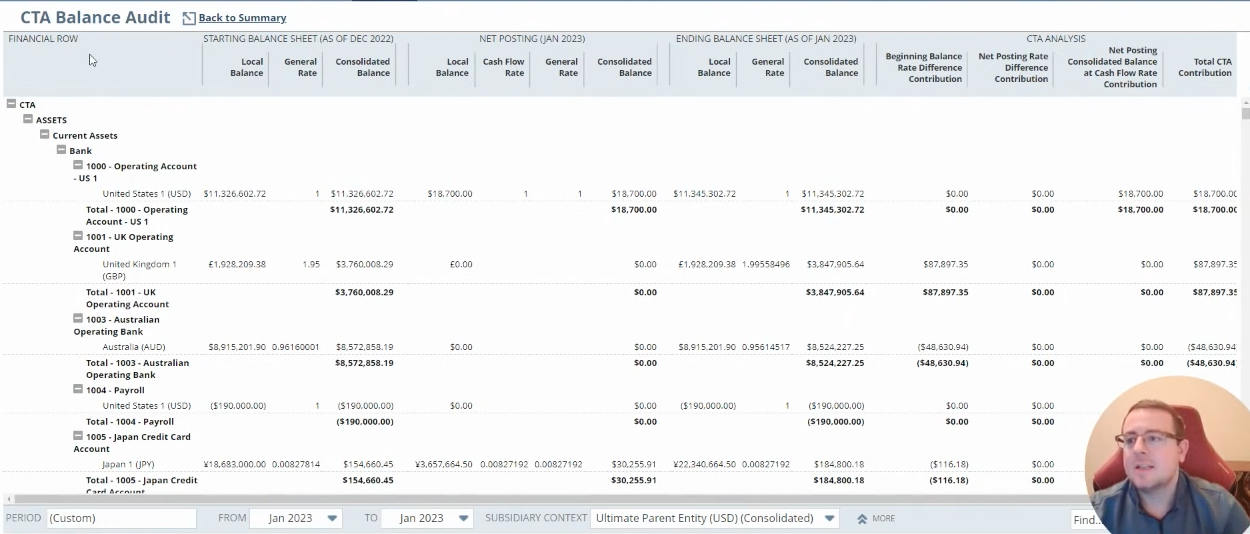

Let’s look at what each column in this report represents.

The financial row on the far left lists the GL accounts in the consolidated trial balance by subsidiary. If you have a lot of GL accounts and a lot of subsidiaries, you're going to see many, many rows in this report.

In the starting balance sheet section, you see that the period referenced is the period prior to the period in our “from” section. This report runs from January 2023, so our starting point is the prior period: December 2022. In terms of the local balance, this is the functional currency balance for that entity in December 2022. The general rate, as you would expect, is the consolidated exchange rate that applies to that particular GL account for the prior period. The consolidated balance is what you get by multiplying the two, taking the local balance multiplied by the consolidated exchange rate for the prior period. At the bottom of the example report, the total for December 2022 consolidated balance is USD $3.277 million.

If we generate a consolidated balance sheet for the same accounting period, our CTA balance as of December 2022 will be that $3.277 million. That's how the balance from the CTA balance audit report ties back to the consolidated balance sheet for December 2022.

In the net posting section of the CTA balance audit report, we see that the period referenced in the net posting section is January 2023. That's because our “from” and “to” periods only referenced the accounting period January 2023. If I were to update this to March 2023, the net posting section would reference January through March 2023 because we’d be looking at the movement in our GL account balances within the range. But for this example, let’s keep this on January 2023.

The local balance column is as simple as looking at the functional currency balance for that particular GL account and subsidiary, specifically the movement in that GL account for the period we're looking at. In the above screen shot, we can see that GL account 1000, our operating account, had a movement in January 2023 of USD $18,700. This logic applies to every GL account across all of our subsidiaries.

Before we get to the cash flow rate and the general rate, let’s take a quick look at a GL account to see where those rates are derived from.

On every GL account in the system, you will set a general rate type and a cash flow rate type. For the most part, we care about the general rate type because that dictates which consolidated exchange rate the system uses for financial reports such as your trial balance and income statement balance sheet. Your cash flow rate type is used when preparing your cash flow statement in NetSuite.

In the CTA balance audit report, the cash flow rate is the consolidated exchange rate for the accounting period in the “to” section. If we ran this from January through March, the consolidated exchange rate referenced would be that for the March accounting period. We can ignore the cash flow rates included in this report because they're not used—they're really for information only.

The general rate type is the consolidated exchange rate that NetSuite will use for the accounting period in the “to” section. To arrive at the consolidated balance, we simply take the local balance and multiply it by the general rate. In other words, we're going to take the movement in the accounting period range we're looking at and multiply it by the consolidated exchange rate for the latest period that we're referring to.

In the ending balance sheet section, notice the accounting period referenced is January 2023, and that's because that’s the period referenced in the “to” section of our report. Starting with the “local balance”, this is the functional currency balance for each subsidiary for each GL account. In other words, the closing balance as at the end of January 2023, for GL account 1000 is just over USD $11 million.

The general rate is the consolidated exchange rate that is applied to each account balance for this accounting period. When we multiply the ending balance by the consolidated exchange rate we arrive at the consolidated balance. This process is repeated for all GL accounts in the trial balance. In fact, if we scroll all the way to the bottom, we will see that the total value of our consolidated balance for the ending balance section arrives at just over USD $4,000,000. You might recall that if we come back to our balance sheet and run it for January 2023, that ties back perfectly to our CTA balance in our consolidated balance sheet.

The final (and arguably most important) section of the CTA balance audit report is the CTA analysis section. Let’s look first at the “beginning balance rate difference contribution column”, whose name lends itself to the calculation behind the numbers. We'll take the local balance from our starting balance sheet and multiply that by the movement in our consolidated exchange rate for the periods that we're looking at. That is, we’ll take the general rate value from our ending balance sheet, deduct the general rate value from our beginning balance sheet, and multiply that by the local balance. This will give us our beginning balance rate difference contribution. For account 1001, the general rate type is close to 2 on the ending balance sheet and 1.95 for the opening balance sheet. That results in a beginning balance rate difference of USD $87,000.

The “net posting rate difference contribution” column is very specific. It looks at the net posting section, particularly the local balance, and multiplies that local balance value by the difference between these two exchange rates, i.e the cash flow rate and the general rate. Depending upon how you have your NetSuite environment configured, you may have your cash flow rates match those for the general rate. In this case, if you scroll to the bottom of your report, you may find that your net posting rate difference contribution column nets to zero. That's typically what will happen when the cash flow rate is set to the same rate as the general rate on all of your GL accounts.

The next piece of this is the “net posting consolidated balance at the cash flow rate contribution”. What we're doing here is taking the net posting local balance and multiplying that by the cash flow rate. Your cash flow rate may be the same as your general rate, but this is how the NetSuite report looks at this.

Finally, the “total CTA contribution” is simply the addition of the first three columns in the CTA Analysis section. We take our beginning balance rate difference and add to it our net posting rate difference. Then, we add to that number our net posting for the consolidated balance at the cash flow rate and arrive at the total CTA contribution for this accounting period. If I scroll to the bottom of our example report, we see that the total CTA contribution for this accounting period is USD $764,000, which we can validate because we know that as of December 2022 our total CTA balance was 3.277 million. That CTA balance updated in January 2023 to just over USD $4,000,000. The difference between the two is the $764,000.

Impact of running for different periods

Let’s look at the impact of running the CTA report for different accounting periods. We know the CTA balance audit report provides a reconciliation of the movement in the CTA balance between two accounting periods. We looked at the period prior to the period referenced in the “from” section of the report and the period referenced in the “to” section of the report. That is, when we were looking at the report for January 2023 to January 2023, we're really looking at the movement from December 2022 to January 2023.

This logic holds true regardless of the accounting periods you're looking at. You can look across multiple accounting periods and/or multiple fiscal years, and all of the logic that we've reviewed so far holds true.

Summary

In this post, we explored the calculation of the Cumulative Translation Adjustment (CTA). We then looked at the CTA balance audit report that breaks down the CTA by account and by subsidiary at the most granular level. We also reviewed how the CTA balance audit report can be used to reconcile CTA movements across multiple accounting periods and across multiple fiscal years.

You should now have a more thorough understanding of the NetSuite CTA account and the role it plays in your financial reporting.

Salto for

NetSuite

NetSuite

SHARE

The Cogs Behind the Cumulative Translation Adjustments (CTA) Account

Sonny Spencer, BFP, ACA

May 5, 2024

15

min read

Introduction

For companies that operate in multiple currencies, the Cumulative Translation Adjustment (CTA) account is a key component of the NetSuite consolidated balance sheet. Because exchange rate differences often arise when converting the financial statements of foreign subsidiaries into the reporting currency of the parent company, the CTA account is crucial for capturing this information and ensuring accuracy across financial reports. In this blog post, we’ll take a closer look at how the CTA is derived and calculated, exploring this process through a canned NetSuite report. We’ll also take a look at the impact of running the CTA balance audit report for different accounting periods.

How is CTA calculated?

CTA is essentially the sum of every GL account balance in every subsidiary in your NetSuite environment, multiplied by its respective consolidated exchange rate.

Imagine you have a Canadian dollar (CAD) trial balance in your NetSuite environment and you need to convert that trial balance into the consolidated currency of US dollars (USD). Your CAD trial balance will net to zero, as all trial balances should.

But now imagine taking each of those balances and multiplying them by different consolidated exchange rates to get to a USD trial balance. Would you expect that trial balance to net to zero? Well, you shouldn't. In fact, the only case where it should net to zero is when each of the consolidated exchange rates—the current rate, the average rate, and the historical rate—are using the exact same exchange rate. As such, the USD trial balance will not net to zero. The difference is actually the CTA, which is the delta on that USD trial balance.

An important note here is that the CTA account is separate from the CTA Elimination account. The CTA Elimination account balance is the delta between intercompany GL accounts that have been eliminated. In other words, the CTA Elimination balance is generated when we run the elimination process in NetSuite. CTA is different, and it's generated when we run our consolidation process.

CTA Balance Audit Report

To review the CTA balance audit report, we’ll first navigate to our consolidated balance sheet in NetSuite, scroll down to the equity section, and reference the CTA balance at the bottom. We can see in the image below that the balance is just over USD $4,000,000 for the accounting period January 2023.

If we click on that balance, NetSuite will take us to the CTA balance audit report for that accounting period.

Let’s look at what each column in this report represents.

The financial row on the far left lists the GL accounts in the consolidated trial balance by subsidiary. If you have a lot of GL accounts and a lot of subsidiaries, you're going to see many, many rows in this report.

In the starting balance sheet section, you see that the period referenced is the period prior to the period in our “from” section. This report runs from January 2023, so our starting point is the prior period: December 2022. In terms of the local balance, this is the functional currency balance for that entity in December 2022. The general rate, as you would expect, is the consolidated exchange rate that applies to that particular GL account for the prior period. The consolidated balance is what you get by multiplying the two, taking the local balance multiplied by the consolidated exchange rate for the prior period. At the bottom of the example report, the total for December 2022 consolidated balance is USD $3.277 million.

If we generate a consolidated balance sheet for the same accounting period, our CTA balance as of December 2022 will be that $3.277 million. That's how the balance from the CTA balance audit report ties back to the consolidated balance sheet for December 2022.

In the net posting section of the CTA balance audit report, we see that the period referenced in the net posting section is January 2023. That's because our “from” and “to” periods only referenced the accounting period January 2023. If I were to update this to March 2023, the net posting section would reference January through March 2023 because we’d be looking at the movement in our GL account balances within the range. But for this example, let’s keep this on January 2023.

The local balance column is as simple as looking at the functional currency balance for that particular GL account and subsidiary, specifically the movement in that GL account for the period we're looking at. In the above screen shot, we can see that GL account 1000, our operating account, had a movement in January 2023 of USD $18,700. This logic applies to every GL account across all of our subsidiaries.

Before we get to the cash flow rate and the general rate, let’s take a quick look at a GL account to see where those rates are derived from.

On every GL account in the system, you will set a general rate type and a cash flow rate type. For the most part, we care about the general rate type because that dictates which consolidated exchange rate the system uses for financial reports such as your trial balance and income statement balance sheet. Your cash flow rate type is used when preparing your cash flow statement in NetSuite.

In the CTA balance audit report, the cash flow rate is the consolidated exchange rate for the accounting period in the “to” section. If we ran this from January through March, the consolidated exchange rate referenced would be that for the March accounting period. We can ignore the cash flow rates included in this report because they're not used—they're really for information only.

The general rate type is the consolidated exchange rate that NetSuite will use for the accounting period in the “to” section. To arrive at the consolidated balance, we simply take the local balance and multiply it by the general rate. In other words, we're going to take the movement in the accounting period range we're looking at and multiply it by the consolidated exchange rate for the latest period that we're referring to.

In the ending balance sheet section, notice the accounting period referenced is January 2023, and that's because that’s the period referenced in the “to” section of our report. Starting with the “local balance”, this is the functional currency balance for each subsidiary for each GL account. In other words, the closing balance as at the end of January 2023, for GL account 1000 is just over USD $11 million.

The general rate is the consolidated exchange rate that is applied to each account balance for this accounting period. When we multiply the ending balance by the consolidated exchange rate we arrive at the consolidated balance. This process is repeated for all GL accounts in the trial balance. In fact, if we scroll all the way to the bottom, we will see that the total value of our consolidated balance for the ending balance section arrives at just over USD $4,000,000. You might recall that if we come back to our balance sheet and run it for January 2023, that ties back perfectly to our CTA balance in our consolidated balance sheet.

The final (and arguably most important) section of the CTA balance audit report is the CTA analysis section. Let’s look first at the “beginning balance rate difference contribution column”, whose name lends itself to the calculation behind the numbers. We'll take the local balance from our starting balance sheet and multiply that by the movement in our consolidated exchange rate for the periods that we're looking at. That is, we’ll take the general rate value from our ending balance sheet, deduct the general rate value from our beginning balance sheet, and multiply that by the local balance. This will give us our beginning balance rate difference contribution. For account 1001, the general rate type is close to 2 on the ending balance sheet and 1.95 for the opening balance sheet. That results in a beginning balance rate difference of USD $87,000.

The “net posting rate difference contribution” column is very specific. It looks at the net posting section, particularly the local balance, and multiplies that local balance value by the difference between these two exchange rates, i.e the cash flow rate and the general rate. Depending upon how you have your NetSuite environment configured, you may have your cash flow rates match those for the general rate. In this case, if you scroll to the bottom of your report, you may find that your net posting rate difference contribution column nets to zero. That's typically what will happen when the cash flow rate is set to the same rate as the general rate on all of your GL accounts.

The next piece of this is the “net posting consolidated balance at the cash flow rate contribution”. What we're doing here is taking the net posting local balance and multiplying that by the cash flow rate. Your cash flow rate may be the same as your general rate, but this is how the NetSuite report looks at this.

Finally, the “total CTA contribution” is simply the addition of the first three columns in the CTA Analysis section. We take our beginning balance rate difference and add to it our net posting rate difference. Then, we add to that number our net posting for the consolidated balance at the cash flow rate and arrive at the total CTA contribution for this accounting period. If I scroll to the bottom of our example report, we see that the total CTA contribution for this accounting period is USD $764,000, which we can validate because we know that as of December 2022 our total CTA balance was 3.277 million. That CTA balance updated in January 2023 to just over USD $4,000,000. The difference between the two is the $764,000.

Impact of running for different periods

Let’s look at the impact of running the CTA report for different accounting periods. We know the CTA balance audit report provides a reconciliation of the movement in the CTA balance between two accounting periods. We looked at the period prior to the period referenced in the “from” section of the report and the period referenced in the “to” section of the report. That is, when we were looking at the report for January 2023 to January 2023, we're really looking at the movement from December 2022 to January 2023.

This logic holds true regardless of the accounting periods you're looking at. You can look across multiple accounting periods and/or multiple fiscal years, and all of the logic that we've reviewed so far holds true.

Summary

In this post, we explored the calculation of the Cumulative Translation Adjustment (CTA). We then looked at the CTA balance audit report that breaks down the CTA by account and by subsidiary at the most granular level. We also reviewed how the CTA balance audit report can be used to reconcile CTA movements across multiple accounting periods and across multiple fiscal years.

You should now have a more thorough understanding of the NetSuite CTA account and the role it plays in your financial reporting.

.png)

.png)